Contents:

The first requirement is for ADX to be trading above 25. Wilder based the initial stop on the low of the signal day. The signal remains in force as long as this low holds, even if +DI crosses back below -DI. Wait for this low to be penetrated before abandoning the signal. This bullish signal is reinforced if/when ADX turns up and the trend strengthens.

For instance, in case you use the ADX crossover indicator as an alternative for the conventional ADX indicator, you may not be able to see the actual fashion energy. A price of ADX above 28 (or 20 – 25 degree) is generally used as an affirmation of trend power and indicates higher probability for the trend to prevail. Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Trend Direction and Crossovers

For example, if the +DI line crosses above the -DI line and the ADX is above 20, or ideally above 25, then that is a potential signal to buy. On the other hand, if the -DI crosses above the +DI, and the ADX is above 20 or 25, then that is an opportunity to enter a potential short trade. Before selling a stock, we must analyze the trend of the particular stock in a weekly and monthly chart. If ADX is above 23 and the +DMI line moves downwards, which is from above to below the -DMI line then this indicates a sell signal.

The chart above shows four calculation examples for directional movement. The first pairing shows a big positive difference between the highs for a strong Plus Directional Movement (+DM). The second pairing shows an outside day with Minus Directional Movement (-DM) getting the edge. The third pairing shows a big difference between the lows for a strong Minus Directional Movement (-DM).

Average Directional Index (ADX)

Although Wilder designed his Directional Movement System with commodities and daily prices in mind, these indicators can also be applied to stocks. The direction of the ADX line is important for reading trend strength. When the ADX line is rising, trend strength is increasing, and the price moves in the direction of the trend. When the line is falling, trend strength is decreasing, and the price enters a period of retracement or consolidation. Similarly , you can use ADX along with Supertrend also to take buy or sell trades. If we get Supertrend buy SIgnal land ADX is above 25 , means buy signal may work well as buy signal has come in a strong trending stock.

- According to Wilder, the directional movement is derived by calculating the difference between these two values (DI+ and DI-).

- Traders can easily switch to any trading tool with a single click.

- Conversely, it is often hard to see when price moves from trend to range conditions.

- ADX growth reflects the strength of the trend but it says nothing about its direction.

- A price of ADX above 28 (or 20 – 25 degree) is generally used as an affirmation of trend power and indicates higher probability for the trend to prevail.

We provide Quality education related forex and indicators tool for your mt4.My all indicators system and robot Give you good trend in daily or weekly charts. Based totally on this price, the ADX or directional movement then equals the cutting-edge excessive subtracted from the preceding excessive and is fine. The average directional index is a trend electricity indicator. The ADX crossover mt4 indicator facilitates traders to dispose of any complexity from the usage of the traditional ADX indicator.

Stocks & Commodities Magazine Articles

However, with the ADX crossover indicator, buyers are alerted to every time there is a crossover of the di+ and di- values. The average directional index helps traders see the trend direction as well as the strength of that trend. Conversely, it is often hard to see when price moves from trend to range conditions.

If the https://traderoom.info/ has increased, the color is green, overwise the color is red. The indicator ColorCandlesDaily draw candles with different colors depending on the day of the week. Smooth these periodic values using Wilder’s smoothing techniques. The calculation example below is based on a 14-period indicator setting, as recommended by Wilder. Directional movement is negative when the prior low minus the current low is greater than the current high minus the prior high.

As with most such systems, there will be whipsaws, great signals, and bad signals. The key, as always, is to incorporate other aspects of technical analysis. For example, the first group of whipsaws in September 2009 occurred during a consolidation. Moreover, this consolidation looked like a flag, which is a bullish consolidation that forms after an advance. It would have been prudent to ignore bearish signals with a bullish continuation pattern taking shape.

Most forex traders are trend traders and follow the trend using… The core of the technical analysis is to identify the trend… This article discusses one of the most sought after technical analysis… If you like to learn how to anticipate market movements and stop using lagging indicators , then you will absolutely LOVE our Sniper Trading System.

Limitations of Using the Average Directional Index (ADX)

The Positive Directional Indicator (+DI) is one of the lines in the Average Directional Index indicator and is used to measure the presence of an uptrend. Calculate +DM, -DM, and the true range for each period. Technical analysis is the key to profitable forex trading.

THETA price analysis: Theta price reaches $1.0, What’s next ? – The Coin Republic

THETA price analysis: Theta price reaches $1.0, What’s next ?.

Posted: Sat, 25 Mar 2023 07:00:00 GMT [source]

For example, the best trends rise out of periods of price range consolidation. Breakouts from a range occur when there is a disagreement between the buyers and sellers on price, which tips the balance of supply and demand. Whether it is more supply than demand, or more demand than supply, it is the difference that creates price momentum. Knowing when trend momentum is increasing gives the trader confidence to let profits run instead of exiting before the trend has ended. However, a series of lower ADX peaks is a warning to watch price and manage risk.

Futures, futures options, and forex trading services provided by Charles Schwab Futures & Forex LLC. Trading privileges subject to review and approval. Forex accounts are not available to residents of Ohio or Arizona. Hypothetical or Simulated performance results have certain limitations, unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity.

Adx buy sell indicator formula Strategy

Wilder’s DMI consists of three indicators that measure a trend’s strength and direction. It can be used to filter trades or generate trade signals. Cory Mitchell, CMT is the founder of TradeThatSwing.com. He has been a professional day and swing trader since 2005.

But there is a drawback with the indicator as there is no filter of the trend strength. The Average Directional Index is a trend strength indicator. It comprises of three variables, namely the DI+, DI- and the ADX. The ADX indicator was designed by Welles Wilder and is used to define the trend.

Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Nordman Algorithms is not liable for any risk that you face using a ready-made indicator from Nordman Algorithms indicators base. A special dashboard scans all available assets and timeframes for signals.

Salesforce Stock Is In A Buy Force Zone (Technical Analysis) (NYSE … – Seeking Alpha

Salesforce Stock Is In A Buy Force Zone (Technical Analysis) (NYSE ….

Posted: Tue, 28 Mar 2023 07:00:00 GMT [source]

When the positive DI moves upwards then there will be an uptrend in the market. When the positive DI moves downwards then there will be a downtrend in the market. Nordman Algorithms is not liable for any risk that you face using the software.

Many adx crossover indicatorrs will use ADX readings above 25 to suggest that the trend is strong enough for trend-trading strategies. Conversely, when ADX is below 25, many will avoid trend-trading strategies. ADX calculations are based on a moving average of price range expansion over a given period of time. The default setting is 14 bars, although other time periods can be used. Full BioCandy Schaap was a long-time price-action trader in traded futures, options, stocks, and bonds.

We’ve provided this powerful fashion trading indicator to you at no cost. You will see extra fluctuation and 2 ma crossover indicator mt4 probable extra whipsaw which may also purpose small losses which could consume up your portfolio quick. If there was an extra placing to filter best the robust crossovers in which the ADX or DM fee become above 28 (or 20 – 25) or a user favored placing.

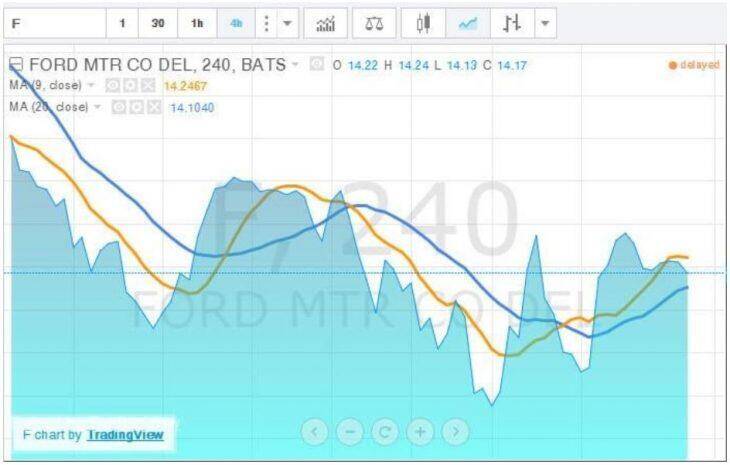

Note that 20 is used instead of 25 to qualify ADX signals. The green dotted lines show the buy signals and the red dotted lines show the sell signals. Wilder’s initial stops were not incorporated in order to focus on the indicator signals. As the chart clearly shows, there are plenty of +DI and -DI crosses.

Cory is an expert on stock, forex and futures price action trading strategies. ADX Indicator settings – this parameter allows traders to set up some ADX Indicator parameters including periods, applied price, ADX level. ADX line is an exponential Moving Average of both –DI and +DI. Growing ADX (along with –DI/+DI going in different directions) confirms that the asset has a particular trend currently. When –DI/+DI are close to each other again, the trend is over. UseThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies.

ADX is non-directional and quantifies trend strength by rising in both uptrends and downtrends. The ADX identifies a strong trend when the ADX is over 25 and a weak trend when the ADX is below 20. Crossovers of the -DI and +DI lines can be used to generate trade signals.

ADX stands for Average Directional Movement Index and can be used to measure the strength and ability of a trend. The ADX indicator is determined as an average of expanding price range values. The ADX Indicator is a component of the Directional Movement System developed by Welles Wilder. In keeping with wilder, the directional movement is derived by way of calculating the difference between those values (di+ and di-). It accommodates of three variables, particularly the di+, di- and the ADX.

She co-authored two books about trading and investing. She was a mentor, speaker, and founder of stockmarket.com, a website dedicated to teaching others how to use technical analysis for trading decisions. The average directional index is a technical analysis indicator used by some traders to determine the strength of a trend. The most common strategy that one can benefit from using this indicator is based on the +DI/-DI crossover. This trading system has a couple of signals that should appear to watch. Before looking at the +DI/-DI crossover, a trader needs to see whether ADX is above 25.

In other words, chartists might consider moving ADX to the back burner and focusing on the Directional Movement Indicators (+DI and -DI) to generate signals. These crossover signals will be similar to those generated using momentum oscillators. Therefore, chartists need to look elsewhere for confirmation help. Volume-based indicators, basic trend analysis and chart patterns can help distinguish strong crossover signals from weak crossover signals.